The term Nootropics has become a kind of catchphrase within the professional and academic communities but even hardcore gamers are seeking their benefits. The question many people have when considering boosting their cognitive performance with these natural and synthetic substances is, which is the best option for me?

Many folks aren’t even sure what Nootropic means or even how to correctly pronounce this term (it’s pronounced: No-uh-tro-pik). Many of these substances can have a major impact on facilitating memory, reasoning, fast reaction, mental endurance and even protecting the brain’s structures from degeneration and the advance of age. A Nootropic supplement will contain a variety of substances designed to address specific aspect s of cognitive function.

For example, one nootropic stack may be designed for the elderly and contain nutrients that promote mental stimulations, enhance long-term memory or protect against cognitive decline. Other are designed to enhance mental acuity, increase the function of working-memory and even allow the mind to maintain high-performance long after it should have quit and gone to bed.

In addition to greatly increasing the mental capacity and performance, nootropic stacks also work to increase the mood and replenish the vital chemical communicators that the brain relies on to feel good and work well.

Stacking nootropics provide a key-turn solution to addressing various aspects of brain health and function, but the trick can be finding the best stack for your needs. Many advanced biohackers support the idea that nootropic stacks should be tailored to the individual. Nevertheless, there are some effective pre-formulated options that can be used by those just entering into the nootropic scene.

These can provide a perfect frame of reference from which future nootropic stacks can be developed.

Finding the Best Nootropic Stack for Your Needs

Formulating your own supplement for improved cognition is not actually too complex. By understanding the benefits and effects of various nootropics, you can choose the ones that will best suit your needs.

Many experts would recommend using a Racetam or Noopept as the solid foundation onto which other nootropics can be stacked. Racetams and Noopepts can greatly enhance cognitive functions but leave the brain a bit deficient in Choline from this increased use. Therefore a source of choline would be an optimal second nootropic for your stack. Choline can be sourced from foods or found in a supplement form.

Finally, there is a wide range of natural nootropics that increase the production of brain chemicals or prevent them from being broken down by natural processes. Others work to increase focus, enhance memory functions, increase mental stamina, reduce distractions, improve the mood and increase creativity and mental performance in countless other ways.

Bacopa Monnieri is one such natural nootropics that have been found to increase memory functions and improve capacity to store and access information. Ginkgo Biloba is also a memory-improving supplement and also enhances the flow of blood through the brain which prevents damage and increases brain function. Others include Cacao that improves the mood, Cat’s Claw that reduces inflammation and increases immunity and Berberine that protects memory channels.

You don’t want to grab every ingredient on the shelf. Rather begin small and choose only the nootropics you have proven useful in your own life. Including a mental stimulant like Caffeine or l-theanine is a good way to top-off the nootropic stack.

Final Thoughts on Nootropics

A single nootropic will give one person godlike powers of inspiration and cognitive prowess, while others may not even notice any effects. This is because the effects of one nootropic will be experienced differently by different individuals for many reasons. Because of this, experts recommend taking time to record your experiences in nootropics in a journal. This will allow you to hone in on the ingredients that are actually working and not waste your cash on ineffective ingredients.

One important consideration is that the brain requires a healthy body to function well. No amount of nootropics are going to increase your capacity to focus and learn if your basic diet, exercise, and sleep habits are off balance. Getting the best results from your nootropics will require increasing your level of personal health and vitality before relying on the use of supplements.

Nootropics are helpful if you buy the right kind and get a good deal on them. If you want to know how to find and use them, you have come to the right place. There are a lot of people selling nootropics these days so you have to be careful.

Nootropics are helpful if you buy the right kind and get a good deal on them. If you want to know how to find and use them, you have come to the right place. There are a lot of people selling nootropics these days so you have to be careful. Stock scanners (

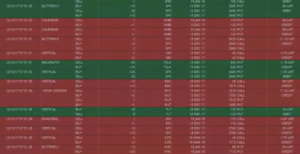

Stock scanners ( Ask any veteran trader, and they’ll let you know that stock scanners have changed everything. Things that used to take traders three to four hours can now be done in a matter of minutes with a few clicks of a button.

Ask any veteran trader, and they’ll let you know that stock scanners have changed everything. Things that used to take traders three to four hours can now be done in a matter of minutes with a few clicks of a button.